A worker cuts a steel coil on the Novolipetsk Steel PAO steel mill in Farrell, Pennsylvania, March 9, 2018.

Aaron Josefczyk | Reuters

User and industrial affirm in each the U.S. and China slowed in April, even ahead of the sector’s two greatest economies entered essentially the most modern allotment of an escalating trade war that would take grasp of a chunk out of international relate.

“The precise message this present day is that each the industrial records from the U.S. and China salvage disappointed. They’re love two boys within the sandbox that are spitting on every other, and it would salvage a lot worse,” stated Marc Chandler, international market strategist at Bannockburn International Forex.

The most modern spherical of tariffs supplied by President Donald Trump and China President Xi Jinping raised the stakes and attainable financial hit on each economies. Trump boosted the tariffs on $200 billion in goods to 25% from 10%, while Xi upped the tariffs on $60 billion in goods.

Economists see a few 0.4 to 0.5% hit on China’s GDP and a few 0.1% hit to the U.S. from the higher tariffs. Strategas Examine estimates the higher tariffs would lower into U.S. relate by 0.1% for every two months the raised tariffs are in situation, or 0.5% a yr.

Trump also threatened 25% tariffs on one more $325 billion in Chinese language goods, which economists reveal could per chance hit Chinese language gross sales and send costs higher for U.S. customers. The impact of these tariffs could per chance per chance be even better on GDP.

China’s retail gross sales rose 7.2% in April, the slowest tempo in 16 years and lower than March’s 8.7% and forecasts of 8.6%. China’s April industrial production rose 5.4%, lower than the 6.5% expected or the 8.5% manufacture in March.

“Here’s the main bit of cleaner records we’re getting, and it paints a necessary much less rosy listing of the economy than moderately just a few folks notion used to be going down,” stated Gareth Leather-based of Capital Economics. Leather-based stated seasonal components could per chance want masked weak point in March records, which confirmed some enchancment and had looked as if it would be signs of green shoots and restoration. “This actually quashes these hopes for the time being.”

U.S. retail gross sales slid 0.2% in April, down from the surprise leap of 1.7% manufacture in March. Automobile gross sales fell 1.1% final month, while gross sales at electronics and appliance stores lost 1.3%. Economists had expected a 0.2% manufacture within the monthly gross sales records, which is main because it reflects the successfully being of the user, about 70% of the U.S. economy.

U.S. industrial production, reflecting whole production at factories, utilities and mines, fell 0.5% after a 0.2% manufacture in March. Manufacturing output dropped 0.5%, led by a 2.6% decline in motor autos and aspects, the third lower in four months and essentially the most modern manufacturing file to display hide softness.

Tariff impact

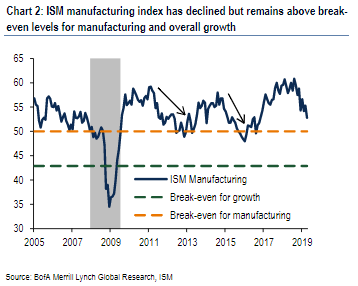

“Autos had an odd swing, as a outcomes of extra inventories,” stated Michelle Meyer, chief U.S. economist at Monetary institution of The US Merrill Lynch. “I’ll be paying rather end attention to manufacturing records, the accept as true with datas, the boldness measures. Or no longer it would be main to gape how the economy is going to fare all the plot by the escalation. Manufacturing has weakened already.” She stated that manufacturing has been falling off since peaking final summer.

She stated the trade wars salvage had an impact on the manufacturing sector, with about 59% of companies within the ISM semi-annual accept as true with announcing that the tariffs salvage resulted in an magnify within the worth of products produced.

Meyer described the weaker April retail gross sales records as “noise,” however stated it bears observing if the tariffs shuffle into situation on the $325 billion in goods since they’d straight impact many user products. Producers were reporting impacts from tariffs, with 59% announcing production charges went up as a consequence.

Markets responded to the news from each international locations by ramping up expectations for central financial institution and other policy easing. U.S. fed funds futures signaled expectations for better than one quarter-level rate lower this yr, while China’s stock markets rallied on expectations of extra fiscal and financial stimulus.

“Both economies softened ahead of the tariff truce ended, however what’s attention-grabbing is quiet we’re no longer talking about recessionary phases. If China grows lower than 6%, that’s a huge deal,” stated Chandler. He stated U.S. relate currently looks to be averaging 2.4% within the main half.

“I accept as true with the potentialities the Fed must lower charges ahead of the tip of the yr salvage clearly increased, given the trade war say of affairs. Or no longer it is quiet no longer my baseline. I accept as true with the Fed has to be cautious in responding to the new trade tensions. Or no longer it is no longer obvious how power this could per chance per chance be, and how this can play out within the precise economy,” Meyer stated.

Trump has many times called on the Fed to lower curiosity charges, along side on Tuesday when he stated China will doubtlessly lower curiosity charges, and if the U.S. did so as successfully it could per chance per chance even be “sport over.”

Leather-based stated if Trump goes by with the next spherical of tariffs, they are going to honest prove being extra spoiled to U.S. customers than to China, since most of the products cannot be sourced in assorted areas. The first spherical of tariffs did no longer enact all that necessary wound to China, and its economy has been in decline for years, he stated.

“It is some distance going to impact China” if the tariffs on $325 billion in goods are implemented, Leather-based stated. “Nonetheless no longer as necessary as folks accept as true with. The impact on the U.S. will likely be extra.” He stated China’s disorders are lingering.

“If you happen to witness at Q1, China’s exports to the U.S. underperformed the relaxation of the sector by 13%, and so that they in total rather necessary match. They shuffle in lockstep. There does seem to be some impact there. Nonetheless whenever you witness at China’s exports to the U.S. as a fraction of GDP, it be about 3%. Thirteen percent of three% is very small. A pair of of the slowdown in China is linked to trade, however a actually small percent,” he stated.

Leave a comment

Sign in to post your comment or sign-up if you don't have any account.