A truck transports original cars at the Port of Veracruz, Mexico.

Susana Gonzalez | Bloomberg | Getty Photos

Honda’s head of American operations, Henio Arcangeli, worries that President Donald Trump’s most up-to-date proposal to slap a 5% tariff on auto imports from Mexico will heed some Americans out of cars correct when auto costs are shut to document highs.

“The tariffs will likely be a peril for us and each person else within the industry,” Arcangeli said in an interview. Appreciate many U.S. and international automakers, Honda imports mighty of its U.S.-sure autos from its manufacturing plants in Mexico. It imported 109,989 of its Match and HR-V models from Mexico remaining 365 days, a extra than 600% jump since 2011, according to Mexico’s Instituto Nacional de Estadística y Geografía, or INEGI.

The North American Free Replace Agreement opened the borders between the U.S., Mexico and Canada within the early 1990s and cleared the trip for an global auto manufacturing industry between the three nations. Mexico is now one among important auto manufacturing countries on this planet, and autos and auto components are important single export, by cost, to the United States.

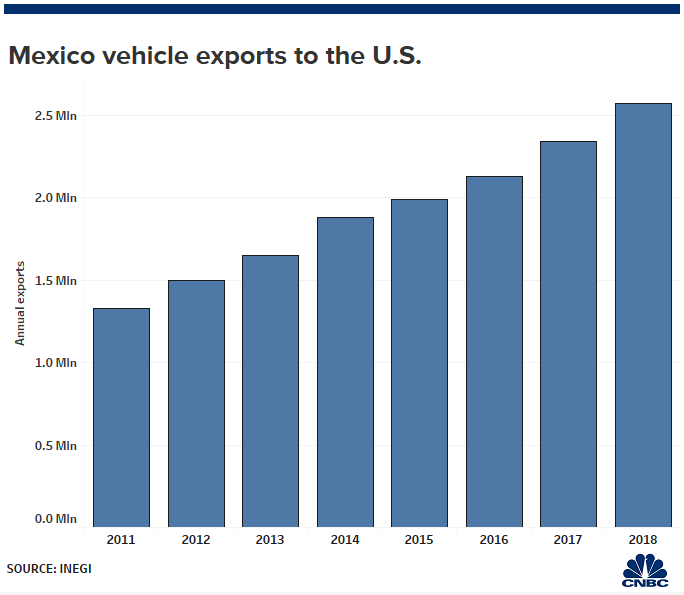

About 2.6 million autos had been shipped north of the border in 2018, valued at extra than $93 billion, up from correct 1.33 million autos in 2011, according to INEGI data. That’s about 15% of the general of 17.30 million autos sold within the states remaining 365 days.

Trump’s the utilization of the tariffs to stress the Mexican authorities to stem unlawful immigration over the southern border. He is threatened to levy tariffs at 5% reach June 10 and “will step by step lengthen till the Unlawful Immigration peril is remedied, at which time the Tariffs will likely be removed,” Trump said in a tweet. By October 1, barring a decision, the tariffs will jump to 25% which, for some Mexican-made cars and light autos can also translate into extra than $10,000 per automobile, he said.

A Ford Motor Co. automobile is driven to an inspection point sooner than being loaded onto a ship for export at the Port of Veracruz in Veracruz, Mexico, on Thursday, Aug. 29, 2013.

Susana Gonzales | Bloomberg | Getty Photos

“Right here is what you will need to undergo in thoughts. Tariff equals tax hike,” said Paul Ingrassia, a Pulitzer Prize-profitable car journalist now working with the Revs Institute, said on CNBC Friday.

Nonetheless even autos assembled within the U.S. — in conjunction with those bearing international price names treasure Toyota, Honda, Mercedes-Benz and Hyundai — would possibly perchance well perchance be hit by the tariffs if a decision is no longer always came across sooner than they move into ticket in decrease than two weeks. American meeting plants ticket vast employ of a serious selection of Mexican-made components and components, similar to wiring harnesses, that are low cost or which contain excessive labor remark. About 70% of the wiring harnesses frail within the U.S. reach from Mexico.

These auto components and components bring the general to $99.6 billion, according to U.S. Census Bureau data.

Even at 5%, the added tariff “potentially can also scrub the deal, in particular for marginal patrons,” said Joe Phillippi, head of AutoTrends Consulting, noting they’ll also add about $1,500 to the associated rate of a favorite Mexican-made Ram 1500 or Chevrolet Silverado pickup. That can perhaps jump fivefold if the tariffs don’t appear to be removed by October. With some pickups and varied Mexican imports topping $50,000 apiece, the tariffs can also add on $10,000 or extra — or force producers to swallow a big share of their profit margins.

The average transaction heed — what prospects in actuality pay after factoring in alternate choices and incentives — will reach a shut to-document $33,457 for Would possibly perchance well simply, LMC Automotive forecast, a 4% 365 days-over-365 days lengthen.

“The auto industry gets hammered” if the tariffs are enacted, with the voice getting worse each and each month as they are elevated, Phillippi said.

It is some distance most likely that the auto industry can also strive to take in some of the added costs, as has been the case with some of the Trump tariffs on imported aluminum and metal, nonetheless that would contain a harsh impact on an industry going by technique of a weakening market. Sales had been off by 2.8% for the length of the principle four months of this 365 days and are anticipated to be down every other 2.1% when Would possibly perchance well simply numbers are launched next week, according to a forecast by LMC Automotive.

Things catch in particular advanced on the aspect aspect. It has become favorite since NAFTA went into ticket in 1994 for components to pass back across what has become a largely invisible border. Some can also gross from Mexico to the U.S. and back again as on the general as seven times, said Steve Kinkade, a spokesman for Honda.

The Japanese automaker imported 107,989 autos from Mexico in 2018, a 611% lengthen since 2011. Its numbers pale when when put next to Overall Motors, which led the industry by importing 666,765 autos from Mexico remaining 365 days, a 109.6% lengthen since 2011. Subsequent in line was once Fiat Chrysler Vehicles, at 504,793 autos, a 206.2% lengthen for the length of the identical duration, according to INEGI data.

A rising checklist of automakers now have autos in Mexico, taking profit of both low-cost labor and that nation’s vast array of free exchange agreements. Totally a 3rd of the autos Nissan sold within the U.S. remaining 365 days came from Mexico, whereas Audi’s original plant shut to Puebla serves because the sole global source of its most up-to-date-technology Q5 sport-utility automobile.

Arcangeli sidestepped remark criticism of the president’s directive, announcing handiest that Honda is “very hopeful” that a decision will likely be came across like a flash, allowing a return to “exchange as fashioned.” Loads of the assorted automakers CNBC approached declined to straight comment, referring as an different to a assertion by the exchange group the Alliance of Automobile Producers

“Our enviornment on tariffs remains unchanged: they are a tax on our prospects, that device they’re sinful to our nation’s economic system and the hundreds and hundreds of American jobs that rely on gross-border exchange,” said a assertion attributed to duration in-between president and CEO Dave Schwietert.

In a Congress that has been polarized for the explanation that 2016 elections, even some Republicans took purpose at the tariff notion on Friday. U.S. Senate Finance Committee Chairman Chuck Grassley of Iowa said “exchange policy and border security are separate factors. Right here’s a misuse of presidential tariff authority and counter to congressional intent.”

The president’s announcement comes two weeks after he chose to delay by up to 6 months the different of enacting tariffs of up to 25% on European-made autos and auto components following a Commerce Department glance that determined they pose a menace to national security. Chinese language-made autos and auto components currently face tariffs due to the U.S.-China exchange dispute.

CNBC’s Emma Newburger, Michelle Fox, Phil LeBeau and Meghan Reeder contributed to this article.

Leave a comment

Sign in to post your comment or sign-up if you don't have any account.